Industry

Develop industry-specific AI solutionsBanking and Finance

Financial Analytics

- Businesses require information right on time to facilitate decision-making processes

- Companies need stringent financial planning and prediction

- Financial analytics is the need of the hour, considering the rapid advancements in tech, diverse demands of the traditional financial sector, and the introduction of new business models

- The future goals of an enterprise can benefit from the improved decision-making strategies with financial analytics

- Tangible assets of a business can be managed better with financial analytics

- The profitability of a company can improve with the in-depth insight financial analytics bring

Credit Scoring

Credit scoring models powered by AI provide an evaluation of data that is comparatively more nuanced than the traditional credit scoring model and can even take into account the data that would previously be deemed irrelevant. The eligibility criteria put forth by AI is complex and thorough, much in contrast to the simple rules followed by the traditional credit scoring models, and ensures that credit-worthy borrowers are not rejected. Additionally, an AI credit scoring model would be self-learning and would continuously improve itself with the introduction of new data into the system.

Fraud detection and prevention

The cutting-edge technology of Machine Learning accurately and automatically detects threats and takes action against them in the shortest possible time. The efficiency of Machine Learning has the financial sector, regulators, and governments investing heavily in security risk management.

Smart advisory & individualized wealth management

Big data and AI has altered the way wealth management professionals execute their tasks. AI has nuanced the traditional “cookie-cutter” approach that categorized the trading preferences of clients as aggressive, conservative, or balanced. Wealth managers and financial advisors can now use AI to get a better understanding of client requirements. AI sentiment analysis can be applied on social media data, and information of customers can be used to derive insights about their present and future financial condition.

Trade solutions

Analyzing complex sets of data AI, through machine learning, identifying unsuccessful trades, its underlying causes and rectifying the same has become easy with AI machine learning. The accelerated remediation of rejected trades has several advantages for financial institutions including the prevention of expensive consequences, market losses, adversely impact on clients, and trading limit or regulatory violations.

Automating Customer Service

AI brings with it chatbots, text, and voice analytics among other use cases. The increasing adoption of these applications is speculated by customer service decision-makers to change the customer and employee experience.

Customer Retention

Companies can implement AI-powered solutions to encourage customers at different stages of the user life cycle to opt for a predetermined action. Getting an insight into the preferences of consumers and using past behaviors to determine the subsequent most appropriate action to be taken is an area where AI or machine learning solution can help to a great extent.

AI insurance

AI and cognitive technologies are especially advantageous to the data-heavy insurance industry and are considered a disruptive force in the space. It streamlines processing large volumes of diverse data, claims, and customer queries.

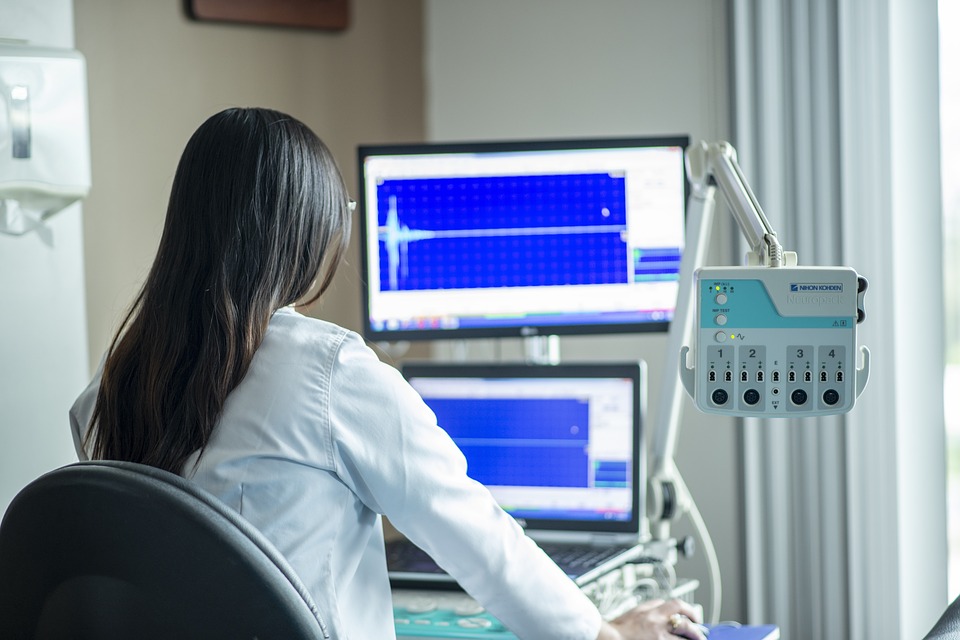

Healthcare

Take healthcare to a new level by introducing the latest in healthcare and lifestyle solutions, tools, and systems to patients and staff.

Medical Registry Automation

Healthcare organizations are opting for advanced analytics tools to derive insights from data to reduce costs and improve the patient experience. AI has brought into focus the significance of effective management of individual health data and clinical records.

Automatic ICD Coding

The complexities incumbent to ICD makes it susceptible to errors since the frequent use of abbreviations in diagnoses leads to faulty matching to ICD codes. Furthermore, many a time two diagnoses that are very similar to one another are encoded in a single combination ICD code. Cases, where doctors write one diagnosis that corresponds to multiple ICD codes, are also not rare. For efficient coding, the process involves a comprehensive understanding of each patient’s health condition.

Unfortunately, medical practitioners rarely posses the required training in professional coding, which brings us to a high-tech solution offered by us to resolve the industry-wide ICD coding issue. The experts at HashCash have introduced a deep learning model that is attention-driven and automatically translates doctors’ diagnoses into the corresponding ICD codes without any errors. Our designs include various recurrent neural networks that enable the model to differentiate the multiple types of ICD definitions and accurately identify unclear semantic information. Our model brings a mechanism of attention to allocate unassociated weights to each diagnostic description a medical practitioner writes to resolve the mismatch between ICD codes and written diagnoses.

Imaging Report Generation

From a subjective perceptual skill, Radiology is transforming into an objective science. With the amount of data increasing exponentially, the need for AI to identify nuances undetectable by the human eye becomes stronger.

Radiologists stand to benefit from AI since it will allow them to focus on other value-added tasks and participate in multidisciplinary clinical teams.

Travel

Make the experience of planning, booking, and going for trips a memorable one for travelers with your global online service.

Customer segmentation and personalization

Personalization and segmentation practices improve customer engagement and facilitates companies to avoid spam and reach target customers with the intended message at the right time.

Flexible pricing solutions

Offer multiple pricing plans corresponding to packages and itineraries customized in line with customer's preference.

Intelligent travel assistance and chatbots

Booking and planning business trips become frictionless with AI-based virtual assistant.

Sentiment analysis

Artificial Intelligence provides the Natural Language Processing system, which derives sense out of unstructured information to optimize sentiment analysis. Companies can utilize the derived intelligence to manage massive volumes of data, comprehend the insights collected from consumers, and merge social data of every kind with other data streams to determine customer preferences with unprecedented accuracy.

Predict demand

Artificial intelligence and machine learning are poised to revolutionize demand forecasting. AI gives demand and financial planners breakthrough capabilities to extract knowledge from massive datasets built from a multitude of internal and external sources. Implementing machine learning algorithms discovers insights and recognizes trends overlooked by human-configured forecasts.

Big data and immense computing power in the cloud enable AI to test and refine hundreds of advanced models simultaneously. Organizations using AI can choose from several options of how it will be applied in demand forecasting, and predict autonomous actions based on cognitive automation.

ECommerce

Sales forecasting

Identify repeated trends in the purchasing behavior of consumers to forsee slumps and spikes in sales. This information can be used to reduce the costs of storage by preventing spoilage and not ordering more than the exact amount of goods.

Individualized shopping and suggestions

Individualize customer experience by offering them options relevant to their preferences. Higher knowledge about the user base creates opportunities to change content and offer timely discounts dynamically.

Fraud detection

Sieve out fake reviews using sentiment analytics, identify suspicious activities, and scams.

Customer support automation and chatbots

Trained bots can serve the role of customer support executives who are always available and are programmed to tackle urgent problems.

Voice assistance

Home assistants are an effective medium to reach out to customers through since those have a live audience every day. Features created for Apple HomePod, Alexa, and Google Home, are a sure-shot way to get your customer's attention.